THE FOUNDATION

Make a gift during your lifetime.

How do you want to structure your lifetime gift?

Make an outright gift

Maximize your deduction and deliver immediate benefits to us.

Make a gift in partnership with the Foundation

Your gift can return financial benefits to you.

Make An Outright Gift

Gifts of Cash

If you want to make a gift today and maximize your charitable deduction, you’ll surely want to consider a cash gift. Cash is the simplest donation and provides immediate benefits. Your gift can be made outright or fund many of our life income arrangements. Gifts of cash include currency, personal checks, money orders, credit cards and wire transfers.

Are there benefits to using cash to fund a charitable gift?

Yes. First, you are entitled to a charitable income tax deduction. Second, this deduction counts against a larger portion of your taxable income than with a gift of appreciated assets. Here’s why: The IRS allows you to claim charitable deductions for gifts of cash up to 50% of your adjusted gross income but only up to only 30% for gifts of appreciated assets.

What if I like the security of having cash on hand?

Your gift can be used to fund a life income arrangement. Life income arrangements are charitable gifts in which you receive an income in return for a gift, either for your lifetime or a term of years.

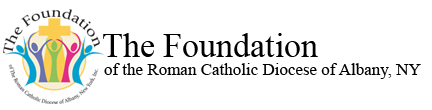

Appreciated Securities

How it Works

- You transfer securities to Roman Catholic Diocese of Albany.

- The Diocese sells your securities and uses the proceeds for its programs.

Benefits

- You receive gift credit and an immediate income tax deduction for the fair market value of the securities on the date of transfer, no matter what you originally paid for them.

- You pay no capital gains tax on the securities you donate.

- You can direct your gift to a specific fund or purpose.

- You can have the satisfaction of making a significant gift now or funding a life-income gift that benefits the Diocese later.

Gifts of Real Estate

Gifts of real estate frequently save you thousands of dollars in income or estate taxes. We accept gifts of residential, commercial, or undeveloped real estate. Gifts of real estate secure a charitable income tax deduction for you, based on the fair market value of the property, with no capital gains liability for the transfer.

What is a gift of real estate?

If the property is a long-term asset (held for over one year), you receive a charitable income tax deduction based on the appraised value. You may apply the deduction for up to 30 percent of your adjusted gross income and carry it forward for up to five additional years. Furthermore, you are freed from paying real estate taxes, maintenance costs, insurance, and capital gains taxes on the property’s appreciation. You also avoid capital gains taxes on the transfer and remove the asset from your taxable estate.

What if I’m still using my real estate?

You can irrevocably deed a residence (such as your home, cabin, or farm) to us but reserve the right to use it during your lifetime. This arrangement creates an immediate income tax deduction and a federal estate tax deduction.

What if I need income?

Your real estate gift can generate income for you by funding a life income gift, such as a charitable remainder unitrust.

Another option is a bargain sale. In this case, we consider purchasing property from you for a price lower than its appraised value. We receive the property, and you receive cash plus a tax deduction.

What we need from you.

We will gratefully review your gift possibility and evaluate the condition and marketability of the property.

- You will need to obtain a philanthropy title report and an independent appraisal.

- Our advisors will inspect the property and complete an environmental checklist. We may need to conduct a phase one environmental study in some cases.

- The IRS requires an independent appraisal to establish the fair market value of the property. We can assist you in following the IRS procedures.

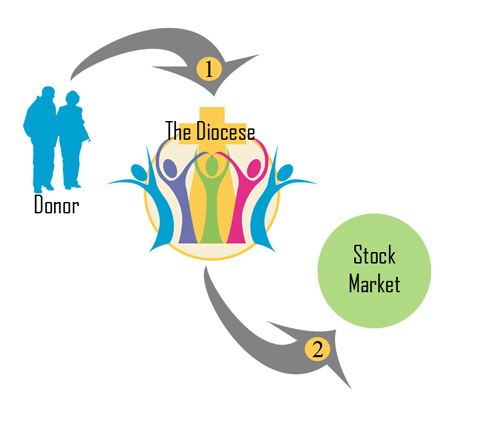

Gifts of Business Interests

How it Works

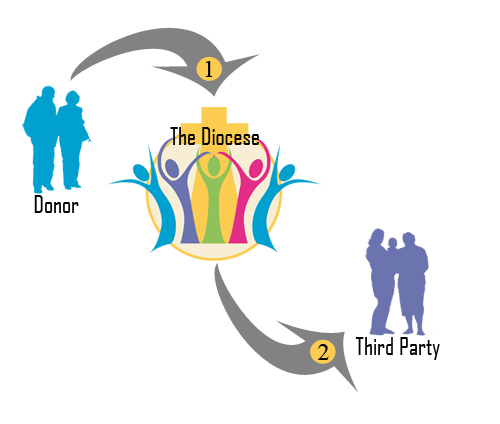

- You give shares of closely-held stock to Roman Catholic Diocese of Albany.

- The Diocese offers the stock back to your company for redemption or re-purchase and uses the proceeds for its programs.

Benefits

- You receive gift credit and an immediate income tax deduction for the appraised value of your shares, even if their original value was close to zero.

- You pay no capital gains tax on any appreciation that has taken place in the shares.

- Under certain conditions, you may be able to use closely-held shares to fund a life-income arrangement, such as a FLIP Unitrust.

- You can have the satisfaction of making a significant gift that benefits both you and the Diocese during your lifetime.

Make a Gift in Partnership

Charitable Annuities and Trusts

A gift to us can also help you with tuition costs, retirement income, and estate preservation.

What are your financial planning objectives?

Primarily interested in increasing your income?

We offer gifts that return income to you and your family

You can give a gift that can increase your income now or in the future. You can even be involved in the management of your gift plan.

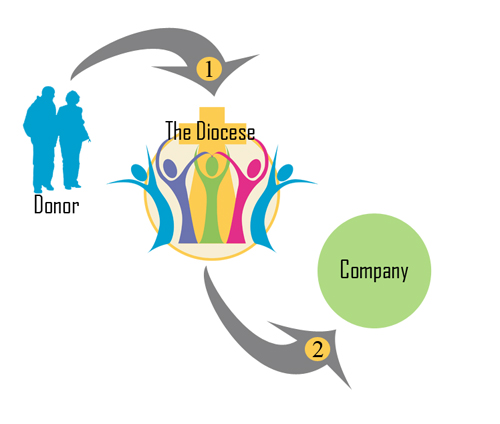

Charitable Gift Annuity

How it Works

- You transfer cash or securities to the Diocese.

- The Diocese pays you, or up to two annuitants you name, fixed income for life.

- The principal passes to the Diocese when the contract ends.

Benefits

- You receive an immediate income tax deduction for a portion of your gift.

- Your annuity payments are guaranteed for life, backed by a reserve and the assets of the Diocese.

- Your annuity payments are treated as part ordinary income, part capital gains income (15%), and part tax-free income.

- You can have the satisfaction of making a significant gift that benefits you now and the Diocese later.

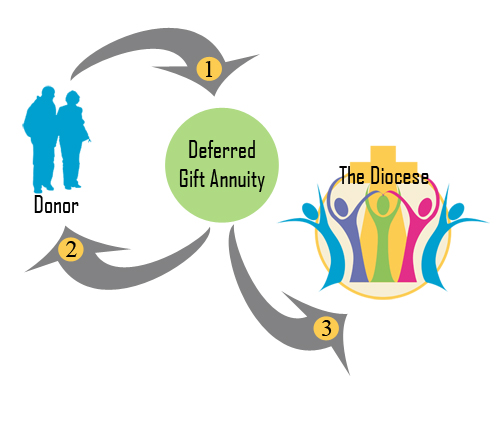

Deferred Gift Annuity

How it Works

- You transfer cash, securities or other property to the Diocese.

- Beginning on a specified date in the future, the Diocese begins to pay you, or up to two annuitants you name, fixed annuity payments for life.

- The principal passes to the Diocese when the contract ends.

Benefits

- You receive an immediate income tax deduction for a portion of your gift.

- You can postpone your annuity payments until you need them, such as when you reach retirement or when a grandchild begins his or her college education.

- The longer you defer your payments, the higher the effective rate you will receive. In the meantime, the principal grows tax-free.

- You can have the satisfaction of making a significant gift now that benefits both you and the Diocese later.

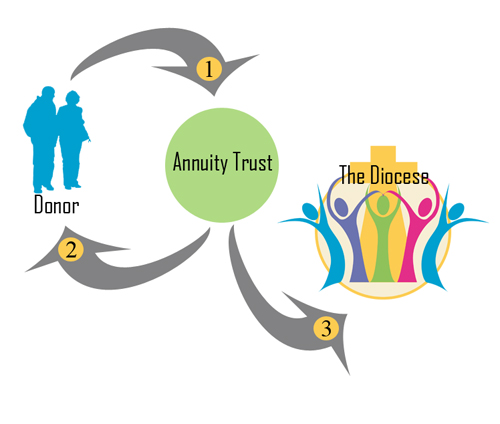

Charitable Remainder Annuity Trust

How it Works

- You transfer cash, securities or other appreciated property into a trust.

- The trust makes fixed annual payments to you or to anyone you name.

- When the trust ends, the principal passes to the Diocese.

Benefits

- You receive an immediate income tax deduction for a portion of your contribution to the trust.

- You pay no capital gains tax on any appreciated assets you donate.

- You or your designated income beneficiaries receive stable, predictable income for life or a term of years.

- You can have the satisfaction of making a significant gift that benefits you now and the Diocese later.

Primarily interested in reducing my estate taxes?

Are you more concerned about long-term estate preservation than an immediate income-tax deduction?

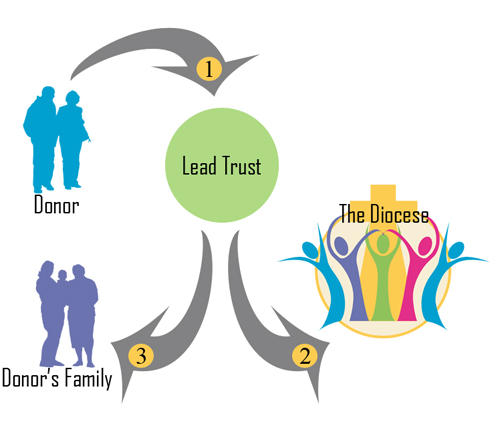

Charitable Lead Trust

How it Works

- You contribute cash, securities or other property to a trust.

- The trust makes fixed annual payments to Roman Catholic Diocese of Albany for a specified term of years.

- When the trust ends, the remaining principal goes to your heirs.

Benefits

- You qualify for a gift tax deduction for the present value of the annuity payments to the Diocese.

- The annuity payments and the term of the trust can be specified in such a way so as to reduce or even eliminate the transfer taxes due when the principal reverts to your heirs.

- All appreciation that takes place in the trust goes tax-free to your heirs.

- You can use your available estate tax credit ($1.5 million per person in 2004; $2.0 million per person beginning in 2006) to further reduce taxes on transfers to your heirs.

- You can have the satisfaction of making a significant gift to the Diocese now that reduces the taxes due on transfers to your heirs later.

Retained Life Estates

How it Works

- You transfer your residence, farm, or vacation home to Roman Catholic Diocese of Albany subject to a life estate.

- You continue to live in the property for life or a specified term of years, while continuing to be responsible for all taxes and upkeep.

- The property passes to the Diocese when your life estate ends.

Benefits

- You receive gift credit and an immediate income tax deduction for a portion of the appraised value of your property.

- You can terminate your life estate at any time and take an additional income tax deduction.

- You can have the satisfaction of making a significant gift now that benefits the Diocese later.

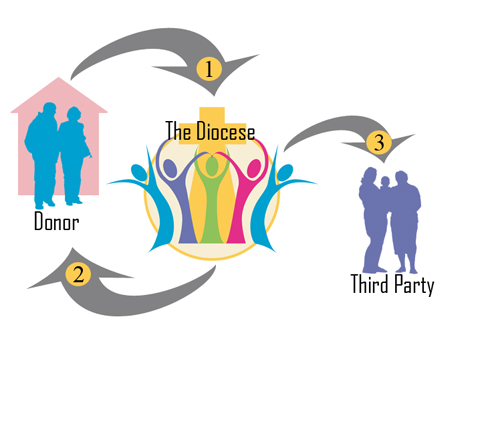

Charitable Bargain Sales

How it Works

- You sell your residence or other property to Roman Catholic Diocese of Albany for a price substantially below the appraised market value, resulting in a transaction that is part charitable gift and part sale.

- The Diocese usually elects to sell the property and uses the net proceeds of the sale for the purpose or purposes you specify.

Benefits

- You receive an immediate income tax deduction for the appraised market value of the portion of the property you donated.

- You pay no capital gains tax on the donated portion of the property.

- You can receive cash from the sale portion to retire a mortgage or for other purposes.

- You can have the satisfaction of making a significant gift to the Diocese during your lifetime.